In the last few weeks, Bitcoin has once again become the center of attention in mainstream media. After breaking a 3-year-long resistance on August 2nd, the popular cryptocurrency quickly reached a local peak of $12,030.

Moments after that, however, investors started selling off, and the price stabilized around $11.5k. These recent events have made many people bullish, claiming that we are in the midst of a new bull market, with the best yet to come.

Demand for cryptocurrency is increasing and the proof is everywhere.

- Paypal and Venmo are rumored to soon allow users to buy and sell Bitcoin directly through their service

- Many brokerages and exchanges now allow inexperienced users to buy Bitcoin with credit card

- Square reported a 186% increase in Bitcoin purchases compared to last quarter and 600% compared to last year

- Goldman Sachs and other big banks are planning to release blockchain-based tokens in the short-term future

Overall, it is safe to say that large organizations are expecting the crypto space to flourish once again, but this time, in a more controlled and regulated space. Naturally, this intrigues the average investor. What seemed like an extremely risky investment just a few months ago, now seems like a golden opportunity.

But is it really worth it? And if so, how can you prepare in the best possible way?

Is It Worth Buying Bitcoin Right Now?

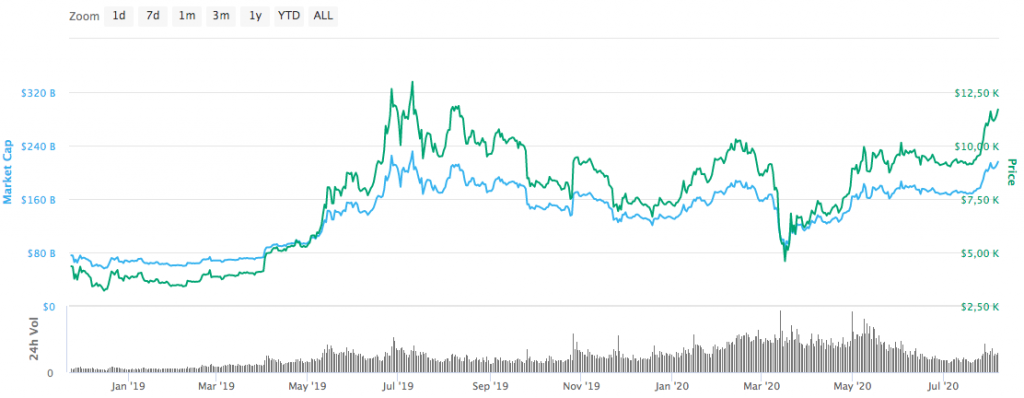

The popular cryptocurrency has seen a more than 120% increase in its price since March 2020. One could argue that the COVID-19 pandemic was partially responsible for a large sell-off that occurred during that period. However, when zooming out, it's easy to see that the price is experiencing a healthy (and consistent) recovery.

Even though fluctuations are present all along the way, we have been experiencing higher lows since December of 2018.

The Halving Is Not Priced In

There is a popular misconception that the public was already aware of the reward halving that Bitcoin experienced back in May. As such, the value of the digital asset was supposedly already "priced in" and shouldn't be a reason to increase demand.

This is inherently a wrong assumption. Due to the halving event, Bitcoin made front-page news once again. Google queries containing the term had seen a massive increase in search volume in the months prior to the event. The halving will certainly not determine the price of Bitcoin, as its supply is irrelevant to the price action. However, it did increase demand massively and showed the public what a deflationary asset stands for. This new wave of investors is currently investing in or sitting at the sidelines expecting Bitcoin to cross its latest peak price.

$20,000 Is the Starting Point

Due to the psychological distress that investors had to go through over the latest bear market, reaching new highs seems almost utopian. For some, $20,000 is the end goal, the target to cash out everything to break even or hopefully make some profit from an otherwise bad investment decision. Currently being at $11k-$12k per coin, it would not make the returns as luring as we're used to.

This, however, is another misconception. The key level of $20,000 per coin should not be seen as dangerous but exciting. When looking at historical patterns, we can see a similar pattern playing out after the bear market of 2014. After recovering from its $200-lows (2014) to its ~$1000 highs (2016-2017), the price potential entered into new territories with no support lines or trading systems to predict a new high.

According to the Stock to Flow model, which has been on point throughout the past few years, we should expect to see Bitcoin priced between $50,000 and $288,000 before 2024, as soon as its highest support is broken.

The Crypto Space Is Constantly Evolving

The biggest reason you should be buying Bitcoin right now is the growth of the space itself. Cryptocurrency has become a lot easier to obtain and use for different purposes. Just 3 years ago, investors could only buy and sell their coins on exchanges, with a small number of exchanges offering an option for open orders.

Nowadays, things look different. Big exchanges offer all types of products, including futures contracts, margin trading, crypto loans, short-term savings, and even the ability to vote using your coins.

The growth of the crypto space has solved one of the biggest challenges of the latest bull market - Bitcoin's user-friendliness.

A second issue experienced in the latest bull market was the inability of exchanges to keep up with user demand. This challenge is now dealt with, as most exchanges have completely automated their verification systems and offer a live chat option on their dashboard. This does not only improve the quality of customer service but also creates a sense of security for potential investors.

How to Prepare In the Best Possible Way

There are few tips to remember as we are entering into a new bull market, and they are best explained by a crypto veteran and host of The Pomp podcast, Anthony Pompliano.

Conclusion

While Bitcoin is certainly a volatile investment, there is still a lot of room for growth. Cryptocurrency is still a relatively new asset class with a lot of potential and applications for the world of the future. We invite you to carefully consider the risks involved in the process and see how Bitcoin can complement your investment portfolio.

You, Me, and BTC Your Liberty & Bitcoin Podcast

You, Me, and BTC Your Liberty & Bitcoin Podcast