This year sees the 10th anniversary of Satoshi Nakamoto's revolutionary white paper that put forward the idea of a "cryptocurrency" – monetary transactions that aren't regulated by a government or financial authority. So it's incredible to think that it's only in the past year or so that bitcoin has hit the headlines and been at the forefront of a mainstream conversation about how cryptocurrencies could permanently transform the global financial landscape.

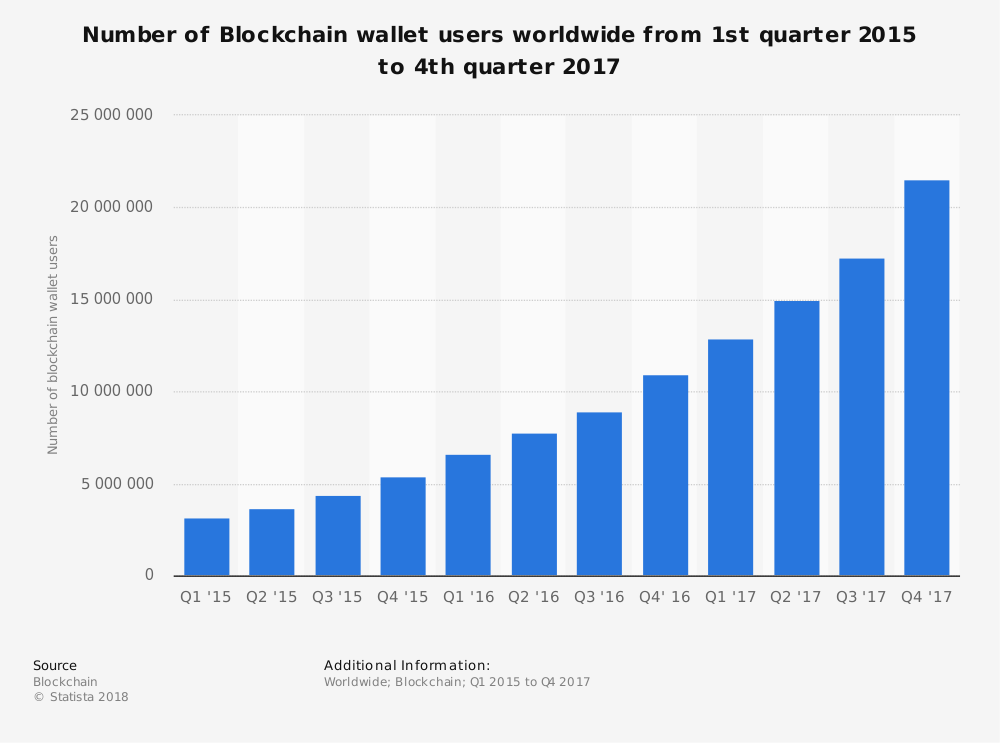

You only have to look at the upward curve of blockchain wallet users over the last few years to get an idea of just how quickly the rest of the world is getting wise to some of the main benefits of cryptocurrency – that it's widely accessible, internationally recognised and cheaper to use (with no transaction fees for exchanges).

Of course, it's impossible to say what relation the figure of over 20 million wallet holders has to the number of people who actually own even part of a Bitcoin. For example, many of the wallets will be empty and others may be owned by corporations, not individuals. However it has been estimated, using data from Crypsa, that the number of actual Bitcoin holders is under 2.5 million worldwide.

However, as soon as the value of Bitcoins started to rise last year – up to a high of $20,000 per Bitcoin – this previously ignored phenomenon has started to attract a whole load more attention from the media, the public, financial institutions and, perhaps most importantly, from governments and other official bodies.

Obviously, for the latter, the unpredictable rise of a currency over which they have no control is a potentially worrying trend. So far, much of the world has taken a wait-and-see approach – however, the likes of Iceland and China have banned any trading. Iceland's caution is understandable following its catastrophic economic meltdown in 2008, and so is China's –the sudden explosion in trading in cryptocurrencies and initial coin offerings could pose a real risk to the country's already faltering economy.

Banks, Hospitals, and Hotels Could Use Blockchain

But what's to become of Bitcoin and cryptocurrencies generally? Were they just a flash in the pan, or will they still make a long-term difference to global finance?

Financial institutions have been taking a long hard look at the way that cryptocurrencies work – in particular the blockchain infrastructure that underpins them. In simple terms, a blockchain is a decentralized, digital public ledger of all the transactions that take place using cryptocurrency. This grows when more blocks (transactions) are added to it and allows people to monitor their transactions without them being held in one central place (i.e. a bank).

Indeed, some banks are known to be experimenting with how to use blockchain for themselves. These range from commercial operations like Goldman Sachs and HSBC to the state banks of countries like Canada, Australia and India. They believe that by using the same technology themselves it could transform the speed of transactions as well as introducing a whole new level of security. However, for all of their enthusiasm for introducing a decentralised system for paying and receiving, some observers have suggested that it will be another decade before they are truly able to use the technology.

While banks are likely the first institutions to start using blockchain, there are many other industries that will be influenced by it, too. For example, it could become the infrastructure of hotels' internal processes and revenue management – as industry giant TUI Group is currently. In healthcare, Blockchain could support the security of supply chain management – reducing time delays, added costs and human errors – and help different healthcare providers share data more effectively. And in entertainment, Blockchain could support a simpler attribution, payment and distribution system without the need for an intermediary payment network or its fees.

Bitcoin Could Transform the World of Retail

While Bitcoin's position among other currencies is far from set in stone, some retailers have already started accepting cryptocurrencies as payment. For example, Expedia has let travellers pay for their hotel bookings with Bitcoin ever since 2014 and Microsoft allows customers to pay for apps, games and movies. They can also be used with the shopping app Gyft to convert into virtual vouchers accepted at over 200 retailers like Amazon, Walmart and Nike.

There are other sectors that are also starting to accept the cryptocurrency as a payment method – and it may be through these that wider acceptance will gradually spread. The future of online gambling could heavily feature Bitcoin, as it's a more secure way of collecting big wins and jackpots than carrying away bags of cash – or paying cash-handling commissions or banking fees.

Anonymity has been a key benefit for users. Gamblers don't need to use their personal details when making transactions – removing the potential risk of customer data theft by hackers. Then there's the fact that the fees themselves amount to little or nothing because there's no need for an intermediary (such as a bank) to be involved.

There are a number of disadvantages to players, too. It's not accepted as a payment option everywhere, and there's always the chance that another form of online cryptocurrency will be released and compete with Bitcoin, which would divide the market. Whenever Bitcoin is hosted on a central network, there's a danger that hackers could gain access to that network's own security system – risking players' money. On top of that, there's the perceived 'dark side' of Bitcoin trading. After all, it built up its popularity on the Dark Web, as a way to illegal trade arms and enable international crime and terror organisations.

Online Casinos Are Reluctant to Adopt Cryptocurrency

Online casinos were among the first adopters of cryptocurrency. At one point, Bitcoin-supported online betting site SatoshiDice was responsible for half of the transactions on the entire Bitcoin network, but apart from that, it hasn't made great inroads into the gambling world much since.

Of course, gambling is an industry that's highly regulated in the UK by the Gambling Commission so their attitude to taking bets in the form of cryptocurrencies will also be critical to its acceptance. So far they have not set down any hard and fast guidelines, but they have urged players to treat digital currencies with caution citing value fluctuations and the history of hacking as two of the reasons.

What the body is absolutely clear on is the need to comply with the Proceeds of Crime Act (POCA) which calls on casinos to have strict anti-money laundering measures by:

-Identifying and verifying customers

-Keeping a record of bookkeeping and training

-Implementing relevant policies and procedures

-Reporting anything suspicious

-Managing regulatory risks

The UK Gambling Commission stipulates that all casino operators must have policies and procedures in place to adequately investigate their customers' source of funds – and be able to demonstrate that these are being implemented effectively. Casino operators must also carry out strict due diligence about the sources of their customers' income by requesting information and verification.

The UK Gambling Commission is aware that digital currencies offer anonymity to players who want to conceal their identity and the sources of their funds – and has told casino operators that in order to accept payments by cryptocurrency, they must be able to satisfy these strict anti-money laundering rules. So far five online casinos stand to lose their licenses over money laundering fears – so the Gambling Commission is taking its responsibility seriously.

Meanwhile, even some of the most forward-thinking organisations in the gambling industry have been reluctant to accept cryptocurrency – so it looks unlikely that any leading regulated online casino will ever accept Bitcoin as a payment method.

Whether it will be remains to be seen and the cryptocurrency has some other hurdles to cross along the way. Among them, they include the need for it to be seen as a more stable form of currency, not subject to the wild fluctuations seen over its decade long history to date.

Bitcoin's Reputation Problem Might Hinder Progress

All the recent focus has primarily been on Bitcoins as an investment opportunity and the reporting of it becomes more fevered as it rises and falls in value. Financial experts like Warren Buffett have commented that the meteoric rise in in the price of Bitcoins looks very much like a bubble to him and, at the recent economic summit in Davos, the head of Canada's National Bank, Stephen Poloz was unequivocal when he called investment in the cryptocurrency no better than gambling.

With such high-profile naysayers, it looks like the Bitcoin has a tough task ahead if it is to improve its reputation within the more conservative elements in the world of finance.

It could be that its route to wider acceptance could be by becoming, first and foremost, a currency for the actual buying of goods and services and only as a commodity for speculation as a secondary consideration.

Summary

-Bitcoin is a digital currency, created and held online

-In late 2017, the value of Bitcoin reached $20,000 for the first time. It's now around $9,500

-However, it's not currently a widely accepted payment option

-Underpinning Bitcoin's security is Blockchain – a global network of computers that manages a database of transactions. This appeals to banks retailers and businesses worldwide – who could start using it collectively in the near future

-The biggest thing holding back Bitcoin is its credibility, with not many high-profile backers, and strong associations with dramatic falls and rises in price and the Dark Web

You, Me, and BTC Your Liberty & Bitcoin Podcast

You, Me, and BTC Your Liberty & Bitcoin Podcast