You and I both know that Bitcoin is revolutionary, but not everyone else agrees yet. There are still plenty of retailers and services out there that do not officially accept Bitcoin. That's why I was instantly interested when I learned that some cryptocompanies offer Bitcoin-funded debit cards. They make it possible to spend your Bitcoin at any place that accepts credit cards (which is nearly everywhere these days).

Credit cards definitely have their issues, but this is still a wonderful solution for the time being. This review is specifically for the Bitcoin debit card from BIT-X.

Ordering and Activating Your BIT-X Bitcoin Debit Card

Getting started with a Bitcoin debit card is relatively simple. If you don't already have a BIT-X account, you'll need to create one before you can can click the "Order BIT-X Card" button. You'll be asked for your name, address, and some other general information. Then the MasterCard will be delivered to your door in a few days. Regular shipping costs 50 mBTC or you can get express DHL delivery for 300 mBTC (more on the fees later). In terms of appearance, the card does look pretty slick.

The next steps are to activate your Bitcoin debit card and link it to your BIT-X account. This involves verifying the card number and something called a package number, which will come included in the envelope. You'll also receive a PIN number, which you'll need for some transactions.

Buy Cool Stuff With Your Bitcoin Debit Card

For the most part, using the card is also quite easy. It's funded by my BIT-X balance, which is always denominated in Bitcoin. Some similar cards convert funds to fiat as soon as they are deposited, but BIT-X waits until a purchase is made. Then the correct amount of Bitcoin is automatically and instantly exchanged at the market rate. That means that I can keep my money in crypto for as long as possible, which I definitely prefer. If the Bitcoin price goes up, so does my spending power.

Used my @bitx2014 #Bitcoin MasterCard last night to go see #MadMax. So far so good. The movie and the card were both pretty darn cool.

— You, Me, and BTC (@YouMeAndBTC) May 28, 2015

The actual payment process is identical to using a normal credit card. My first purchase was a ticket to Mad Max at a movie theater. Everything there went off without a hitch. The cashier simply swiped the card and I was good to go. Likewise, everything went well when I bought some fuel and some snacks at a gas station.

Ordering goods online takes a bit more effort, but it works equally well. Just like with any other credit card, I had type in my name, the card numbers, and the expiration date. Amazon approved the card right away though, and there is currently a Bluetooth/FM transmitter en route to my door. I didn't realize until after I completed the order that it would take a month to ship from China, but that's my own damn fault.

The Ultimate Pro: Spend Bitcoin Anywhere

When it comes to listing all the great things about having a Bitcoin debit card, there's really only one thing that comes to mind. (Is there really that much to like about credit cards?) That said, it is a serious benefit and it probably outweighs all of the cons. It's the fact that this card allows me to spend Bitcoin basically anywhere.

The bottom line here is that I like Bitcoin. I want to keep my money in Bitcoin as much as possible, but not everyone accepts it. Sure, I can manually convert my Bitcoin to USD (and that is getting easier), but it still takes effort. With a Bitcoin debit card, however, I can make the exchange happen the second I purchase something. It's quite literally no hassle at all. I can simply use my Bitcoin at will - anytime, anywhere.

The Cons (It's Still a Credit Card)

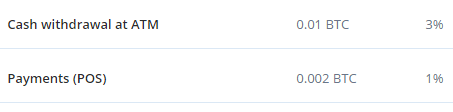

The biggest gripe I have here is that this Bitcoin debit card is expensive. I already mentioned the initial shipping cost. Then there's a 50 mBTC activation fee. Then when you're finally ready to spend your coin, you're charged an extra 1% plus 2 mBTC. If you try to grab some cash at an ATM, you'll be out 3% plus 10 mBTC. Those fees aren't deadly, but they are annoying - especially when a normal credit card pays me at least 1% back.

The biggest gripe I have here is that this Bitcoin debit card is expensive. I already mentioned the initial shipping cost. Then there's a 50 mBTC activation fee. Then when you're finally ready to spend your coin, you're charged an extra 1% plus 2 mBTC. If you try to grab some cash at an ATM, you'll be out 3% plus 10 mBTC. Those fees aren't deadly, but they are annoying - especially when a normal credit card pays me at least 1% back.

Another issue for some people might be the identity verification that's necessary to raise your transaction limits. Without completing the process, you're limited to spending 250€ per year. This could present a privacy concern for many people in the Bitcoin space.

The user interface on BIT-X.com looks beautiful at first glance, but the debit card functions feel a touch clunky. For instance, when I make a transaction with my card, I'm notified via a private message. That means that there's no normal transaction list like you might see on a bank statement. Rather, I have to sort through my BIT-X inbox to investigate my activity. Correction: There is a nice list for card related transactions! It took some time for me to find but it is quite helpful. There are a few other aspects that are similarly odd, but nothing that ruins the service.

My last issue occurred at an ATM. I tried to make a withdrawal several times but it never worked. It wouldn't even execute a balance inquiry without displaying some generic error message that said I should contact my financial institution. That said, I made all of those attempts at the same time and at the same ATM, so it might be worth another shot. I'll update this post if I can get it working eventually.

Conclusion

A Bitcoin debit card is not the same as cold hard Bitcoin, but it's still pretty darn cool. The BIT-X card has some hefty fees, but if you're not a gigantic cheapskate, it's still worth using, simply as a way to support the general Bitcoin ecosystem.

Leave a comment and let me know if you'd use a Bitcoin debit card to spend your Bitcoin!

You, Me, and BTC Your Liberty & Bitcoin Podcast

You, Me, and BTC Your Liberty & Bitcoin Podcast

I use the BitPay card and have never had an issue swiping in a store, shopping on line – or even at an ATM. And the Shipping cost was FAR less than the BIT-X

Yes, the Shift card appears to be ok. It is linked with either DWOLLA or coinbase; if you can stomach that then you can use it. It looks great, functions well, and currently there are NO transaction fees for purchases, etc… There is a charge for international transactions of 3%, but none for USA ones. It’s a $10 cost to get the card, so the price in BTC fluctuates as per the current price/value.

I’m pretty new to all this and I personally like this approach, though I do realize the nature of how coinbase works isn’t really for the BTC purist.

I plan on using a type of multi-use approach to it all, keeping some with 3rd party wallets and also storing some value in entirely anonymous/secure/cold storage places. I hope this all makes sense. Do you think I’m being an idiot in some way by using coinbase for part of my coin dealings? They do essentially remove all hopes of remaining anonymous or pseudonymous but it’s not like they restrict your ability to opt out to more secure wallets at any time.

Anyhow, if you can reply somehow that’d be great, but if not perhaps you could chat about this on a show someday soon. Thanks guys 🙂

Its a pretty good idea. Takes the Bitcoin off the virtual-only viewpoint because you can directly pay with your card. If you know your balance then it makes no difference in the experience of paying. Its like paying with your normal debit card. I did use a similar thing with Paypal in the past, worked like a charm. Now lets just hope we get this Bitcoin card accepted everywhere!

I use coinjar’s “Swipe” card, and it works very well. But it only works in Australia. https://blog.coinjar.com/2014/09/24/what-you-need-to-know-about-coinjar-swipe/

isn’t the whole idea of a “bitcoin credit card” an oxymoron?